How to return file online ITR for salaried person

Hi Guys,

We are talking about how to e-filing Income Tax Return.First question comes in our mind, why we fill return e-filing ITR. because As you pay tax that tax is used for common resources like create or maintenance of roads, water tanks etc. So let's Start with topic e-filing ITR..

*For E-filing ITR, You required the following document.

- PAN Card

- Aadhar Card

- All bank details of which you had open account with bank's IFSC code

- Form 16

then As you can see that right upper corner, If you have not register to e-filing website then you need to register into the website or If you already register to e-filing then click Login Button.

For Login purpose, PAN number is your User Id and fill the password,birthday date and captcha.

you can see home page.

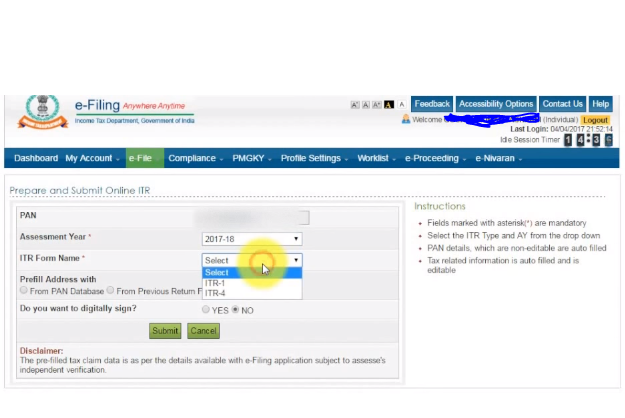

For Prepare and submit Online ITR, you can see the e-file option on screen.click and goes to "Prepare and Submit online ITR". Screen is show below.

Select ITR form Name as ITR-1(Salaried) fill the details and submit it.

You can see as like below screen

*Instruction:

Do not press BACKSPACE button on form fill time.

After 15 minutes, User automatically logout So after filling the details click to save draft that prevent to data loss and resume the session.

Fill your personal details on personal information like address,email address,name etc.

-Income details:

Income salary fill from Form 16(B) take Gross total.

Select type of property you have and fill the amount you pay for it or gain from it.

If you have any other resource that you get money then fill amount 'Income from other sources'.

On deduction, fill amount of LIC, tuitions fees of children,PF etc. on 80C field

If you have medical premium for your family then fill amount on 80D.

-Tax details:

it shows total tax deduction from your salary.

If TDS amount is greater then tax payable amount then you get refund. If TDS amount is less then tax payable amount. you have to pay tax.

Fill the self assessment tax payment if you have paid tax.

Check your amount on Tax paid and verification and fill the bank details which you have open account.

Under 80G form, fill the Donation paid to government or NGO

Please check all the details you filled in document.

Then Click to Prepare and submit Button.

🌝

Thank you for visit.....

If you have any questions about article please comment below.

You can see as like below screen

*Instruction:

Do not press BACKSPACE button on form fill time.

After 15 minutes, User automatically logout So after filling the details click to save draft that prevent to data loss and resume the session.

Fill your personal details on personal information like address,email address,name etc.

-Income details:

Income salary fill from Form 16(B) take Gross total.

Select type of property you have and fill the amount you pay for it or gain from it.

If you have any other resource that you get money then fill amount 'Income from other sources'.

On deduction, fill amount of LIC, tuitions fees of children,PF etc. on 80C field

If you have medical premium for your family then fill amount on 80D.

-Tax details:

it shows total tax deduction from your salary.

If TDS amount is greater then tax payable amount then you get refund. If TDS amount is less then tax payable amount. you have to pay tax.

Fill the self assessment tax payment if you have paid tax.

Check your amount on Tax paid and verification and fill the bank details which you have open account.

Under 80G form, fill the Donation paid to government or NGO

Please check all the details you filled in document.

Then Click to Prepare and submit Button.

🌝

Thank you for visit.....

If you have any questions about article please comment below.

1 comments:

Click here for commentsNice content

ConversionConversion EmoticonEmoticon